Where can I withdraw USD or Riel from ATMs in Siem Reap?

How to Grab USD or Riel from ATMs in Siem Reap – Avoid the Big Bill Trap!

Where can I withdraw USD or Riel from ATMs in Siem Reap? BRED Bank ATMs are your best bet—they charge just $4 per transaction with a $2,000 withdrawal limit, while most other banks hit you with $5-8 fees and measly $500 limits. All ATMs primarily dispense USD to foreign cards, not Riel, but that’s actually perfect since you’ll get Riel naturally as change when spending dollars.

Your Essential Siem Reap Money Guide

The game-changer? Download the new Bakong Tourists App for cashless QR payments at most vendors, drastically reducing your need to ask “where can I withdraw USD or Riel from ATMs in Siem Reap?” in the first place. Smart strategy: Make one big BRED Bank withdrawal for your cash buffer, then use Bakong for 90% of daily spending—you’ll save serious money and skip the ATM hunt entirely.

The Siem Reap Money Maze: A Traveler’s First Hurdle

I’ll never forget the sting of my first Siem Reap ATM receipt. A crisp $100 bill in my hand, but my bank account was $106 lighter. That $6 fee could have bought me three delicious plates of Kuy Teav noodle soup. It was then I realized that for travelers in Cambodia, understanding the money game isn’t just about budgeting—it’s about survival.

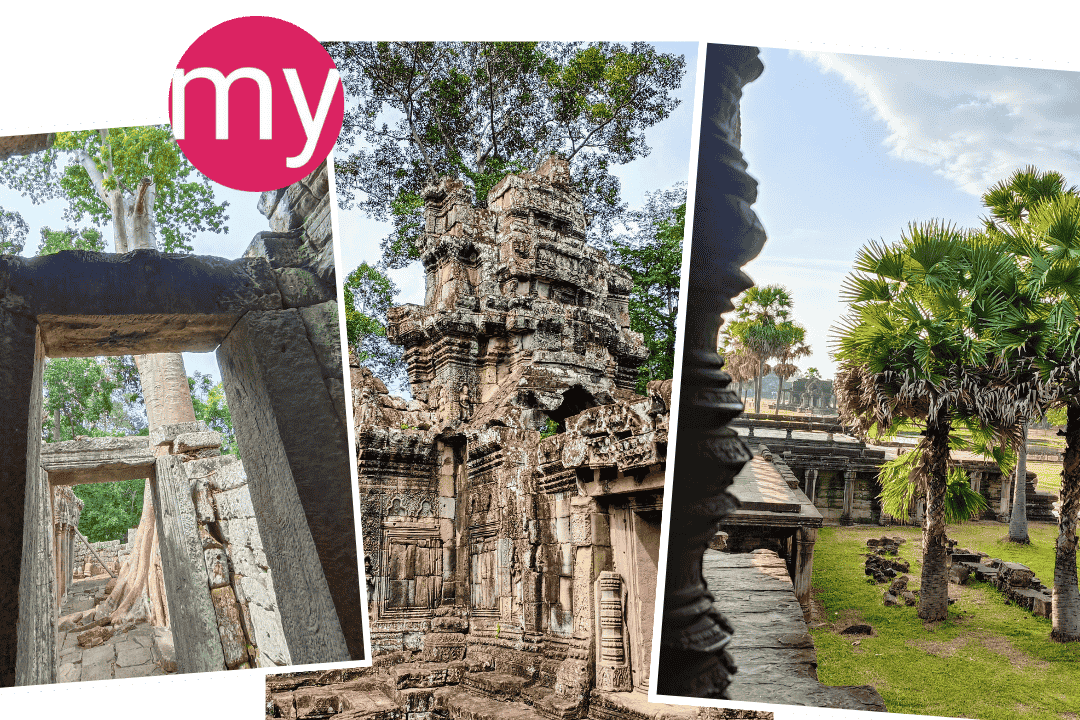

So, you’re planning a trip to the magnificent temples of Angkor. You’ve got your tours booked, your camera ready, but a nagging question remains: how do you handle money? Is it better to withdraw US Dollars or Cambodian Riel? Are all ATMs the same expensive trap? And how can you avoid getting crushed by fees that can, believe it or not, add up to the cost of a full-day private tour?

Let’s cut through the confusion. This isn’t just another travel blog post; it’s a data-driven guide for 2025 to help you navigate Siem Reap’s unique financial landscape like a seasoned pro.

Executive Summary: Your Cheat Sheet to Siem Reap’s Money

No time to read the whole thing? Here are the absolute essentials:

- Currency: ATMs in Siem Reap primarily dispense US Dollars (USD) to foreign cards. Getting Riel directly is rare and, frankly, not necessary for most travelers. You’ll get plenty of Riel as change.

- Fees are Universal & High: Every single ATM charges foreign cards a fee, typically $4 to $8 per transaction. This is on top of whatever your home bank charges. There are no “fee-free” options, so don’t waste your time looking.

- The Clear Winner: BRED Bank is the undisputed champion for travelers. It has the lowest fee ($4) and the highest withdrawal limit ($2,000). This is the single most important piece of information for withdrawing cash efficiently.

- The Digital Revolution: The new Bakong Tourists App is a major development. It allows you to make cashless QR code payments across Cambodia, often bypassing the need for ATMs entirely. This is the future of tourist spending in Siem Reap.

- The Strategy: A hybrid approach is best. Use the Bakong App for small daily payments (coffee, tuk-tuks, market stalls) and a BRED Bank ATM for one or two large cash withdrawals to cover your entire trip’s cash needs.

Understanding the Two-Currency System: USD vs. Riel in Practice

Before we talk about ATMs, you need to grasp Cambodia’s peculiar but functional dual-currency system. It might seem confusing at first, but it’s actually quite convenient once you get the hang of it. After the turmoil of the late 20th century, the US Dollar became a trusted store of value and is now an unofficial second currency (MySiemReapTours).

Today, the US Dollar (USD) is the de facto currency for most tourist-related expenses. Think hotels, tours, restaurant meals, and, importantly, the Angkor Pass tickets. The Cambodian Riel (KHR), the country’s official currency, is what you’ll use for smaller, everyday transactions like street food, local market purchases, and most often, as change for your dollar payments.

Cambodia’s dual-currency system in practice, with US Dollars used for larger transactions and Cambodian Riel for smaller change

The Magic Exchange Rate

What makes this whole system work so smoothly is the stable, unofficial exchange rate that everyone uses: 4,000 KHR to 1 USD. While the official rate from the National Bank of Cambodia (NBC) might fluctuate slightly (around 4,006 KHR as of August 2025), for day-to-day transactions, 4,000 is the number. This makes mental math incredibly easy.

Pro Tip: You will often pay for something in USD and receive your change in a mix of USD and KHR. For example, if your coffee is $1.50 and you pay with a $5 bill, you might get back three $1 bills and 2,000 Riel. It’s essential to carry small, crisp USD notes ($1, $5, $10). Larger bills can be difficult to break, and many vendors will refuse torn or old-looking notes.

Learn the best spots to get easy cash in both USD and Riel and dodge those hard-to-use $100 notes for smooth spending everywhere!

The Gentle Push for the Riel

It’s worth noting that the Cambodian government and the NBC are actively promoting the use of the Riel in a process known as “de-dollarization.” They’ve encouraged phasing out small US notes and are pushing for digital payments in the local currency (XTransfer Analysis 2025). This national pride initiative is a key reason behind the development of the Bakong payment system, which we’ll cover shortly.

The ATM Deep Dive: Your Guide to Withdrawing Cash in Siem Reap

So, you need cash. You head to an ATM. This is where a little knowledge can save you a lot of money. Poor ATM choices can easily cost you an extra $50-100 during a two-week trip—that’s a full day’s budget for many travelers (MySiemReapTours Fee Analysis).

The Inescapable Truth About ATM Fees

Let’s be crystal clear: there are no fee-free ATM withdrawals for foreign cards in Cambodia. Anyone who tells you otherwise is misinformed. You will always be hit with two separate charges:

- The Local ATM Operator Fee: This is charged by the Cambodian bank that owns the ATM. Fees universally range from $4 to $8 USD per transaction (Crown Currency).

- Your Home Bank Fee: This is what your own bank charges you for using an international ATM and/or for currency conversion. This can be another $5 plus a percentage of the withdrawal amount.

The key to minimizing these costs is to reduce the number of times you visit an ATM. This means withdrawing larger amounts at once from a machine that has a low fee and a high withdrawal limit.

The table below illustrates why the withdrawal limit is just as important as the fee. To get $2,000 in cash, the difference in cost is stark.The Ultimate ATM Ranking for Foreigners in Siem Reap (2025)

After analyzing traveler reports and bank fee schedules, there is one bank that stands head and shoulders above the rest for foreign visitors.

BRED Bank: The Clear Winner

BRED Bank is, without a doubt, the best option. It consistently offers the lowest fee combined with the highest withdrawal limit, a combination that dramatically reduces your overall costs.

- Lowest Fee: A flat $4 per transaction (BRED Bank Cambodia).

- Highest Limit: Up to $2,000 per withdrawal (Reddit User Report).

- Transparency: The machine clearly discloses the fee before you confirm the transaction.

You can find BRED Bank ATMs in central locations like the Pub Street area and near major hotels in Siem Reap. Using one of these machines just once can save you $15-20 in fees compared to using other banks multiple times.

The table below illustrates why the withdrawal limit is just as important as the fee. To get $2,000 in cash, the difference in cost is stark.

| Bank | Foreign Card Fee (USD) | Withdrawal Limit (USD) | Cost to Withdraw $2000* | Our Verdict |

|---|---|---|---|---|

| BRED Bank | $4 | $2,000 | $4 (1 transaction) | 🏆 The Best Choice |

| ACLEDA Bank | $5 | $500 | $20 (4 transactions) | Reliable Network, but Costly |

| Canadia Bank | $5 | $500 | $20 (4 transactions) | Common, but Expensive |

| Vattanac Bank | $4–$5 | Varies (often ~ $500) | ~$20 (4 transactions) | Good Fee, Lower Limit |

| Maybank | $5 | $500 | $20 (4 transactions) | Deceptive (may not warn of fee) |

| Wing Bank | $5 | Varies | Varies | Often doesn’t disclose fee upfront |

Consolidated list of Google Maps links by bank and zone (Airport, Pub Street/Old Market/Sivutha Blvd, National Road 6).

Airport (SAI – Siem Reap–Angkor International Airport)

- BRED Bank (airport ATM)

- Google Maps: https://www.google.com/maps/search/BRED+Bank+ATM+Siem+Reap+Angkor+International+Airport?hl=en Google Maps

- Confirmation: BRED’s official ATM location at SAI BRED Bank and SAI guide noting BRED ATM Hello Angkor

Pub Street / Old Market / Sivutha Blvd cluster (central)

- ACLEDA Bank ATMs (Pub Street / Sivutha)

- Pub Street area search: https://www.google.com/maps/search/ACLEDA+Bank+ATM+near+Pub+Street+Siem+Reap?hl=en Google Maps

- Sivutha Blvd focus: https://www.google.com/maps/search/ACLEDA+Bank+ATM+Sivutha+Boulevard+Siem+Reap?hl=en Google Maps

- Canadia Bank ATMs (Pub Street vicinity)

- Pub Street area search: https://www.google.com/maps/search/Canadia+Bank+ATM+Pub+Street+Siem+Reap?hl=en Google Maps

- Maybank ATMs (central Siem Reap)

- Citywide search: https://www.google.com/maps/search/Maybank+ATM+Siem+Reap?hl=en Google Maps

- J Trust Royal Bank ATMs (central Siem Reap)

- Citywide search: https://www.google.com/maps/search/J+Trust+Royal+Bank+ATM+Siem+Reap?hl=en Google Maps

- SATHAPANA Bank ATMs (central Siem Reap)

- Citywide search: https://www.google.com/maps/search/Sathapana+Bank+ATM+Siem+Reap?hl=en Google Maps

- Prince Bank ATMs (central Siem Reap)

- Citywide search: https://www.google.com/maps/search/Prince+Bank+ATM+Siem+Reap?hl=en Google Maps

- Vattanac Bank ATMs (central Siem Reap)

- Citywide search: https://www.google.com/maps/search/Vattanac+Bank+ATM+Siem+Reap?hl=en Google Maps

National Road 6 (airport road / NR6 corridor)

- ACLEDA Bank (NR6 and adjacent)

- Sivutha/NR6 list (covers multiple ACLEDA ATMs close to NR6 corridor): https://www.google.com/maps/search/ACLEDA+Bank+ATM+Sivutha+Boulevard+Siem+Reap?hl=en Google Maps

- Canadia Bank (NR6)

- National Road 6 focus: https://www.google.com/maps/search/Canadia+Bank+ATM+National+Road+6+Siem+Reap?hl=en Google Maps

Notes and confirmations

- ABA network (USD and KHR dispensing) citywide (for context and planning your own map searches): ABA’s ATM network overview ABA Bank Cambodia

- Angkor Ticket Office (has on‑site ATM; cards and multiple currencies accepted at counters).

Case Studies: Applying Your Money Smarts on MySiemReapTours

Theory is great, but let’s see how this plays out in real-world scenarios during your tours in Siem Reap.

Case Study 1: The Beng Mealea Expedition

- Scenario: You’re booked on the incredible Beng Mealea Siem Reap Tour. The entrance fee is paid separately at the ticket booth.

- Application: The ticket office accepts USD. By having already made a single, large withdrawal from a BRED Bank ATM, you have the crisp, clean USD notes ready. This prevents the panic of having to use a potentially expensive, unknown ATM near the remote temple complex, saving you both time and money.

- Link: Learn more about the Beng Mealea Entrance Fee in 2025.

Case Study 2: Fueling Your Angkor Wat Sunrise Tour

- Scenario: You’re on the magical Private Angkor Wat Sunrise Tour. Inside the park, you’ll want to buy coffee, breakfast from a local stall, and perhaps some small souvenirs.

- Application: This is where the dual-currency system shines. You use a small USD note ($5 or $10) to pay for your coffee. You receive change in Cambodian Riel, which you can then use for smaller purchases without worrying about breaking another large dollar bill at 6 AM.

- Link: See how Cambodian Currency vs US Dollars works in Angkor.

Case Study 3: The Sunset Tour & The ATM Fee Trap

- Scenario: After a long, amazing day on the Angkor Wat Sunset Tour, you realize you’re low on cash for dinner. You spot an ATM right outside the temple exit and use it out of convenience.

- Application: This is a classic traveler mistake. An ATM in a prime tourist spot might charge a premium fee of $7 or even $8. This single, unplanned withdrawal could cost you double what a planned withdrawal at a BRED Bank would. It reinforces the need to plan ahead.

- Link: Read our full investigation into ATM fees for foreign cards.

Case Study 4: Budgeting for a Private Monk Blessing

- Scenario: You’ve included a sacred monk blessing in your Private Angkor Wat Sunrise Tour. It’s customary to leave a small donation.

- Application: Having a mix of small USD notes and Riel is perfect for this. A donation of a few dollars or a few thousand Riel is appropriate and easy to manage when you’ve planned your cash situation, making the experience smooth and respectful.

The Future is Here: Why the Bakong Tourists App Beats ATMs

While mastering the ATM game is crucial, a new technology is changing how tourists spend money in Cambodia. For most of your daily expenses, you might not need cash at all.

Bakong is Cambodia’s national digital payment system, a blockchain-based platform launched by the National Bank of Cambodia. It’s powered by KHQR, a universal QR code that allows you to pay almost anywhere—from tuk-tuks and street vendors to high-end restaurants and supermarkets (Khmer Times).

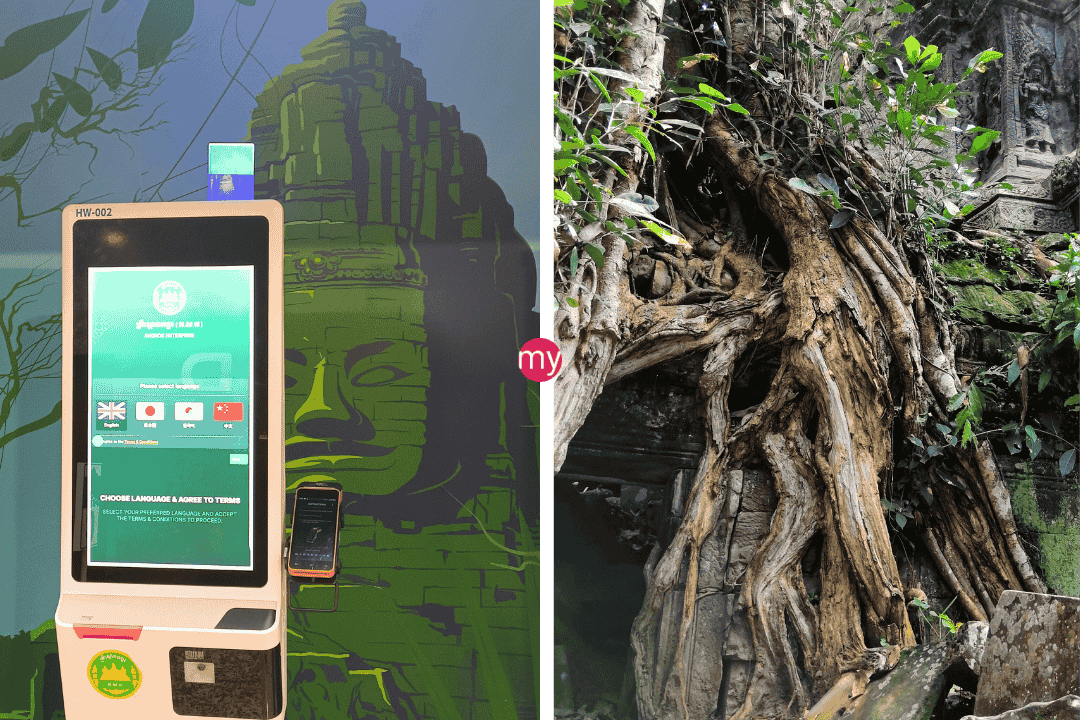

Introducing the Bakong Tourists App (Launched August 2024)

Previously, using the KHQR system required a local Cambodian bank account. But with the launch of the “Bakong Tourists” app in August 2024, that barrier is gone. This app is specifically designed for visitors.

How it Works:

- Download: Get the “Bakong Tourists” app from the Apple App Store or Google Play Store.

- Register: Sign up quickly with your email and basic details. No local phone number or address needed.

- Top Up: Fund your digital wallet using your international Mastercard or Visa directly in the app, or with cash at participating kiosks (including at the Siem Reap airport upon arrival).

- Pay: Simply scan the KHQR code displayed by any merchant to pay instantly and securely from your phone.

This system allows you to pay the exact amount for even the smallest purchase, eliminating the need for physical change and reducing your reliance on cash.

ATM vs. Bakong Tourists App: The Real Deal

ATM Withdrawals: The Necessary Evil

- What it’s for: Stocking up on fat stacks of cash (because let’s face it, you need a buffer)

- The damage: Brutal fees of $4-$8 per transaction — plus whatever your home bank decides to pile on

- The hunt: You’ll spend half your vacation searching for that one magical low-fee ATM

- The awkward reality: Ever tried buying street food with a $20 bill? Good luck with that

- Security nightmare: Walking around with wads of cash like you’re in a heist movie

- Bottom line: Painful but unavoidable for your emergency stash

Bakong Tourists App: The Game Changer

- What it’s for: Everything else — literally your daily spending superhero

- Sweet savings: Minimal to zero transaction fees (your wallet will thank you)

- Ultimate convenience: Accepted at millions of merchants — just whip out your phone

- Precision payments: Pay exactly $2.37 for that perfect bowl of noodles (no more awkward change situations)

- Fort Knox security: Digital wallet beats stuffed pockets every single time

- The real talk: This handles 90% of your spending like a boss

The Verdict That Actually Matters

ATMs = necessary for your “oh crap” cash reserve Bakong = your new best friend for literally everything else

Why carry around a fortune in your pocket when you can pay like a local with a tap?

Your 2025 Siem Reap Money Strategy: A Final Action Plan

So, let’s put it all together. Here is your simple, three-step strategy for handling money in Siem Reap.

Before You Go

- Inform your home bank of your travel dates to avoid your card being blocked.

- Ask your bank about their international transaction fees so you know the full cost.

- If possible, pack around $100-$200 in clean, crisp, small-denomination USD notes ($1, $5, $10, $20) for your immediate arrival.

Upon Arrival in Siem Reap

- Download the Bakong Tourists App and top it up with a few hundred dollars. This will be your primary payment method.

- Locate the nearest BRED Bank ATM. Make one large withdrawal ($500-$1000, depending on your trip length and budget) to create a cash fund for your entire stay.

Daily Spending

- Use the Bakong App for everything you can: cafes, restaurants, market stalls, tuk-tuks that show a KHQR code.

- Use your withdrawn USD cash for tour entrance fees (like the Angkor Pass), at places that don’t have a QR code, and for tips.

- Use the Riel you accumulate as change for very small purchases, like a bottle of water or a piece of fruit.

And that’s it. By combining the efficiency of one smart ATM withdrawal with the convenience of modern digital payments, you can navigate Siem Reap’s money maze like a pro, saving your money for what truly matters: the incredible experiences that await you in the Kingdom of Wonder.

References & Data Sources

This report was compiled using data and information from the following credible sources:

- National Bank of Cambodia (NBC): For official policies, exchange rates, and information on the Bakong payment system.

- BRED Bank Cambodia: For official information on ATM fees and withdrawal limits.

- World Bank Cambodia Economic Update: For broader economic context on tourism and finance in Cambodia.

- MySiemReapTours.com: For traveler-focused analysis and on-the-ground fee investigations.

Brought to you by Dan and Mat, Your tour planners.

Featured

Explore more on My Siem Reap Tours

Koh Ker and Beng Mealea guided tour | Banteay Srei temple guided tour | Angkor Wat Sunrise tour | Private Angkor Wat Sunset Tour | Koh Ker and Beng Mealea guided tour | Morning Siem Reap floating village tour | Afternoon Siem Reap floating village tour | Private Angkor Wat special tour | Kulen Waterfall small group guided Tour | Private Angkor Wat mix temples photo tour